[ad_1]

Stocks on Wall Street moved sideways and US bonds steadied on Monday as investors looked ahead to a key Federal Reserve meeting later this week.

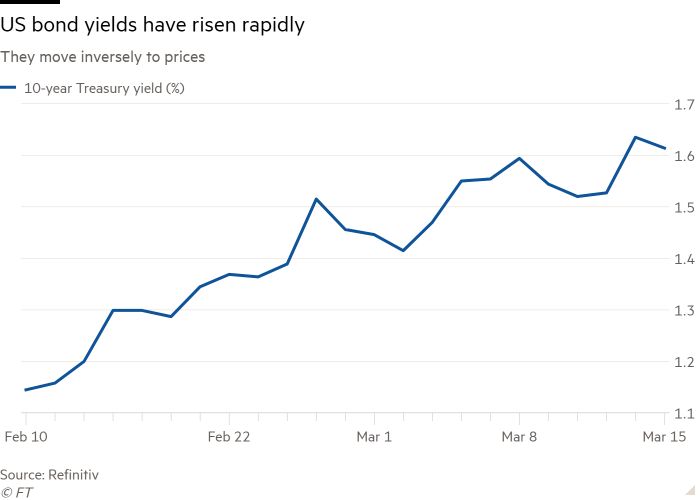

The blue-chip S&P 500 index edged up 0.1 per cent at the opening bell, while the yield on the benchmark 10-year Treasury was little changed at 1.61 per cent, having hit a 13-month peak above 1.64 per cent on Friday.

A two-day meeting of the Fed’s policy-setting panel, which ends on Wednesday, will attract particularly close scrutiny from global traders after a sharp retreat in the Treasury market sent yields surging last week. While rates remain low by historic standards, the pick-up comes as the US and global economic rebound are still in a fragile state.

This week’s meeting of the Federal Open Market Committee “will likely dictate where yields and risk trade for days, if not weeks ahead”, said Jim Reid, research strategist at Deutsche Bank.

“Chair [Jay] Powell is likely to emphasise that significant uncertainties remain and that the recovery has a long way to go, particularly the labour market,” he added.

Melissa Davies, chief economist at broker Redburn, said there were two divergent forces at play at the moment: “There’s the concern over inflation, which is pushing up yields, and there’s the stimulus, but I think we’re in more of a bullish environment in the short term.”

After President Joe Biden signed into law a $1.9tn relief package, which included direct payments to most Americans, Davies said some people would use the cheques to pay for necessities and others would invest the money or pay down debt. “I would think that some of it will go into tech stocks,” she added.

According to a Deutsche Bank survey of their online brokerage account users, investors plan to use 37 per cent of their $1,400 stimulus cheques in the stock market, with the figure varying by age and income level.

In Europe, the region-wide Stoxx 600 index rose 0.3 per cent, taking the benchmark to its highest level since February last year, while Germany’s Xetra Dax and the UK’s FTSE 100 both gained 0.2 per cent.

A morning sell-off in UK government debt faded on Monday. The yield on the 10-year gilt hit its highest point since March last year, before sliding to 0.82 per cent in the afternoon. The Bank of England is not expected to push back against a recent rise in yields at its monetary policy committee this week. Andrew Bailey, the central bank’s governor, told the BBC’s Today programme on Monday that the uptick in interest rates in recent months had been “consistent with the change in economic outlook”.

Norway’s Norges Bank and Turkey’s central bank also have meetings in the coming days in what will be a busy week on the monetary policy front.

Europe’s bond market will also see a flurry of issuance activity, with Germany, France, Spain, Finland and Slovakia set to raise about €25bn in debt, according to UniCredit. France may also sell a green bond, the Italian lender said.

In Asia, China’s CSI 300 index closed down 2.2 per cent, Hong Kong’s Hang Seng gained 0.3 per cent and South Korea’s Kospi slipped 0.3 per cent.

The drop in China’s market follows a series of pullbacks that have come amid heightening concern the country will tighten fiscal and monetary policy in the face of what a senior official described recently as “bubble” risks.

Oil prices rose modestly on Monday as the prospect of economic normalisation and curbs on supply pushed prices higher. US marker West Texas Intermediate rose to $65.82 a barrel but later fell 1.1 per cent to $64.90. International benchmark Brent rose to $69.43 a barrel but later fell 1.1 per cent to $68.48.

“We’ve seen the Opec+ maintaining their limit on oil supply and we’re seeing more economies reopening, which means there’ll be more of a demand on oil,” said Sophie Chardon, cross-asset strategist at Swiss bank Lombard Odier, pointing to the decision earlier this month by the Opec cartel and its allies such as Russia to refrain from a big supply boost.

[ad_2]

Read More: Wall Street stocks waver and US bonds steady with Fed in focus

2021-03-15 12:58:30