[ad_1]

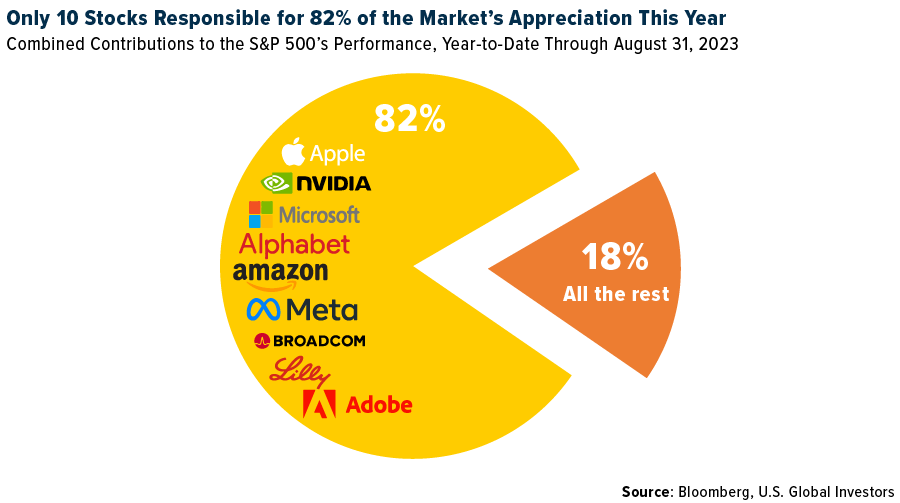

Stocks are up 18.7% year-to-date, which is good news for portfolios and 401(k)s, but did you know that most of the heavy lifting has been done by a very small number of S&P 500 stocks?

You may be surprised to learn that more than 80% of gains so far in 2023 are due to the performance of only 10 companies, starting with Apple. The iPhone maker, valued at just under $3 trillion, contributed a not insignificant 15.6% to the market’s moves.

Apple was followed by a who’s who of mostly Silicon Valley and artificial intelligence (AI) companies. These include, in descending order, graphics card manufacturer NVIDIA (responsible for 15.4% of the gains), Microsoft (12.0%), Google parent Alphabet (9.6%, combining Class A and Class C shares), Amazon (8.6%), Facebook parent Meta Platforms (7.0%), Tesla (6.5%), semiconductor firm Broadcom (2.7%), drugmaker Eli Lilly (2.7%) and Adobe (1.8%).

There are a number of implications here that investors should be aware of, the most important being a lack of diversification. Investors who own an S&P 500 index mutual fund or ETF may be more exposed to concentration risk than they realize. Because the S&P is capitalization-weighted, superstar companies like Apple and Microsoft have a disproportionately massive impact on the index’s performance.

Also consider vulnerabilities to sector-specific risks. Most of the S&P 500’s gains in 2023 came courtesy of a single sector: technology. Any regulatory changes, economic shifts or other potential risks affecting tech will, once again, have a disproportionate influence on the index and any portfolios tracking it.

The Case for Sector Rotation

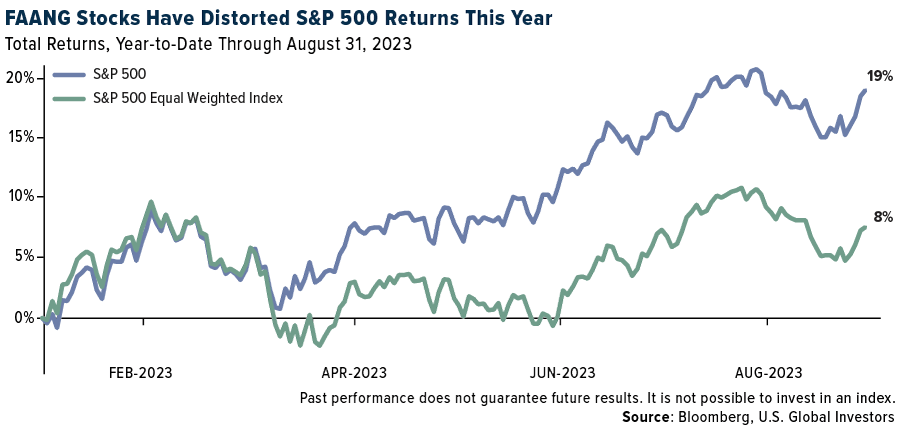

This may be easier to visualize if we compare the year-to-date performances of the S&P 500—which is weighted by market cap, remember—and the S&P 500 Equal Weight Index (EWI). As the name implies, the EWI includes the same 500 names as the original recipe index, but each company is given a fixed weight of 0.2%. Apple, then, has the same allocation as much smaller companies like Ralph Lauren (market cap: $7.65 billion) and Alaska Air ($5.74 billion).

As you can see, the market cap-weighted index significantly outperformed the EWI, 19% to 8%.

Given the current tech-sector focus, a sector rotation strategy may make sense for some investors.

Historically, leadership among sectors changes over time due to various factors such as interest rates, economic cycles, consumer sentiment and more. In a different economic environment, the next sector to lead the market could be financials or health care.

Though (tech) equities have been the star performers this year, it may be wise for investors to reconsider the role of other asset classes, including bonds, commodities, real estate, gold and Bitcoin. Many of these assets often have low correlations with stocks and could offer a cushion in times of volatility.

As loyal readers know, I recommend a 10% weighting in gold, with 5% in physical bullion and jewelry, the other 5% in high-quality gold mining stocks and funds.

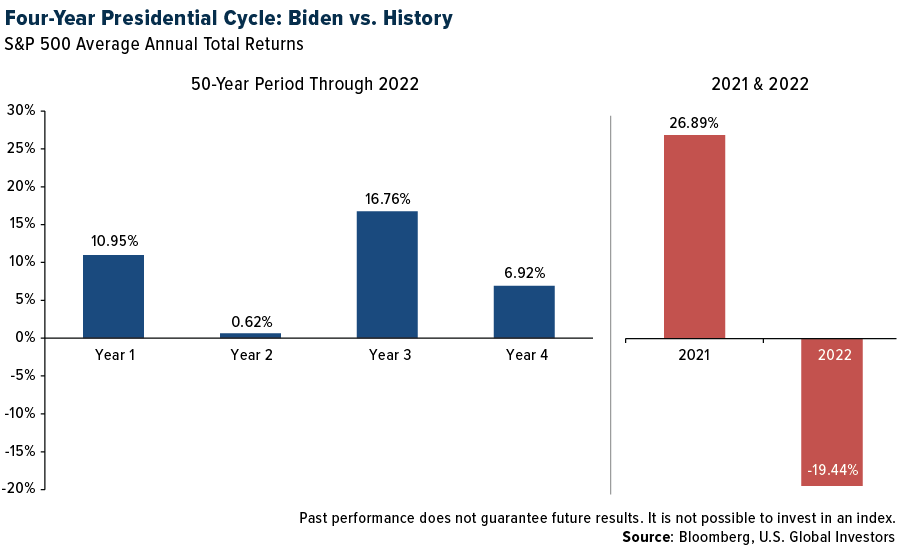

The Four-Year Presidential Cycle

Another factor for investors to keep in mind is seasonality—specifically, the four-year presidential election cycle, something I’ve written about many times before. The third year of a president’s term has historically performed better than the other three years, the reason being perhaps that he’s looking ahead to reelection at the end of year four and is focused on market-friendly policies to support the economy.

Whether that’s the case with Joe Biden is up for debate, but the market’s respectable performance so far this year—the third of Biden’s four-year term—is in line with historical precedent.

Of course, none of this accounts for risk factors I already mentioned, like geopolitical tensions, inflation or unexpected economic downturns. Although it doesn’t guarantee better results, a diversified portfolio is still preferred for risk mitigation.

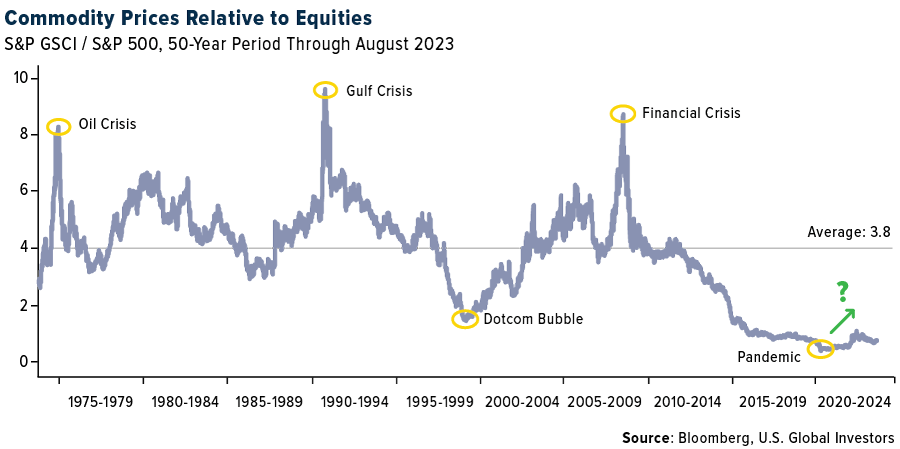

The Dawn of a New Commodities Bull Market?

Speaking of diversification… We could be on the cusp of another structural bull market in commodities, if Stifel analysts’ projections are correct. In a report published this week, the financial services company suggests that metals and minerals are gearing up to dominate the market for the next decade after 13 years of underperforming stocks and fixed income. Indeed, commodity prices have not been keeping pace with equities, but that may be soon to change.

As Stifel sees it, a “perfect storm” of factors are stirring the pot, including the emergence of ESG (environmental, social and governance) investing, which has hiked up capital costs in the commodities sector, making higher returns imminent. Policies leaning toward the electrification of everything—think electric vehicles (EVs) and smart grids—are also going to tighten supply elasticity while increasing demand.

BRICS+ nations (Brazil, Russia, India, China and South Africa) are adding inflationary pressure to the mix by ramping up commodity demand. Western countries, meanwhile, are in debt up to their eyeballs, meaning the current monetary tightening cycle may be followed by a prolonged period of loose policymaking—good news for real, non-interest-bearing assets like commodities, gold and other minerals.

Besides gold, I prefer metals that will increasingly see higher demand as a result of decarbonization and electrification efforts. These include copper, lithium, nickel, cobalt and silver.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.43%. The S&P 500 Stock Index rose 2.40%, while the Nasdaq Composite climbed 3.25%. The Russell 2000 small capitalization index gained 3.56% this week.

- The Hang Seng Composite gained 2.01% this week; while Taiwan was up 0.99% and the KOSPI rose 1.77%.

- The 10-year Treasury bond yield fell 5 basis points to 4.178%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was SkyWest, up 10.6%. BNEF Oil research expects the demand for jet fuel to drop across September and October, in line with the seasonal trend as the end of the summer peak travel period transitions to the fall season lull.

- According to Stifel, seasonally adjusted volume data from LA/LB is encouraging, showing consecutive months of outperformance versus normal seasonality. LA/LB and the market share of imports has rebounded to 33%, up from 26%, and now well-above year-over-year and the 12-month average. While Stifel believes some rerouted shipments to the east coast are permanent, the group expects a substantial portion will eventually make its way back to LA/LB, providing a small tailwind to intermodal versus east coast.

- According to Bank of America, Japanese airlines look poised to deliver a second quarter beat and fiscal year 2023/24 guidance raise as peak summer demand arrives. Beyond the summer, the bank sees the Japanese airlines as beneficiaries of structurally higher inbound and transit demand helping keep international yields elevated consistent with stubbornly high yields globally.

Weaknesses

- The worst performing airline stock for the week was Qantas, down 6.70%. According to RBC, European air passengers grew 13% year-over-year in July to 93% of pre-pandemic levels. This compares to 90% in June/ 93% in May/ year-to-date. However, on a month-on-month seasonally adjusted basis, passenger numbers weakened by 0.7. Air passengers increased on a month-over-month basis for 13 of the 19 months in 2022 and 2023 year-to-date. Some airlines commented on strong ex-UK leisure demand in May supported by three UK bank holidays in the month, which may have created a strong comp for June and July on a month-over-month basis.

- According to Bank of America, Panama Canal drought disruptions shows a negligible impact for container shipping but building congestion for bulk. The bank’s checks suggest slowing upward momentum in container spot rates with capacity being added and the end of the seasonal peak looming. Tanker has seen rates fall to below P&L breakeven on seasonality, OPEC+ cuts, a pullback in Chinese imports and Russian exports shifting to the dark fleet – but forward markets continue to anticipate a better fourth quarter 2023 to first quarter 2024. And dry bulk rates are bouncing along the bottom – but the worst has passed for vessels returning from congestion and seasonality should support a better September to November ahead.

- American Airlines Group Inc. was fined $4.1 million for keeping thousands of passengers on the tarmac for hours without giving them a chance to deplane. The Department of Transportation said it was the largest fine levied against an airline for violating its tarmac-delay rule, which requires airlines to give fliers an opportunity to deplane in case of delays of three or more hours on domestic flights.

Opportunities

- According to UBS, its I China survey indicates positive travel intentions for the second half of the year, which include: 1) more than 60% of respondents who travelled in the past six months expect to increase their travel frequency in the next six months; 2) the expected travel frequency of tier-1/2 city respondents who plan to travel in the next 12 months has returned to the April 2019 survey level; 3) travel duration and travel budgets have also increased since the April 2019 survey. The recent resumption of outbound group tours to more markets could help accelerate the recovery during this time.

- German Hapag-Lloyd is accompanied by three local players in the bidding war for the large South Korean container shipping company HMM. According to local media, the two companies Hyundai Motor Group and Posco Group have dropped out, as the deadline for submitting preliminary bids has now expired. This means that in addition to Hapag-Lloyd, there are now only the following remaining in the…

[ad_2]

Read More: Is It Time for Investors to Consider Sector Rotation Amid a Tech-Heavy S&P 500?

2023-09-01 20:35:27