[ad_1]

In his challenging new book The Power of Money, former Harvard economist Paul Sheard boldly says that “government debt never has to be repaid” provided the debt is denominated in the issuer’s own currency and that the currency is a widely acceptable one.

Governments are in the business of financing not only things such as health, welfare, education and other domestic spending but also areas such as defence and military power projection, as well as international development spending on infrastructure and foreign aid of many different types. The ability to do this by means of borrowing – which, according to Sheard, never needs to be repaid – is a coveted privilege which might transform the global balance of economic and financial as well as political and strategic power if it becomes more widely available.

By the same token that he rejects the notion that debt ever has to be repaid, Sheard dismisses the idea that such debt represents a burden on future generations. Numerous high-profile international economists who have endorsed his book appear to agree.

Government debt, he argues, looks similar to corporate or household debt but is fundamentally different. The banking reserves created by a government running a budget deficit no more have to be repaid than do banknotes, provided the government can issue debt in its own currency.

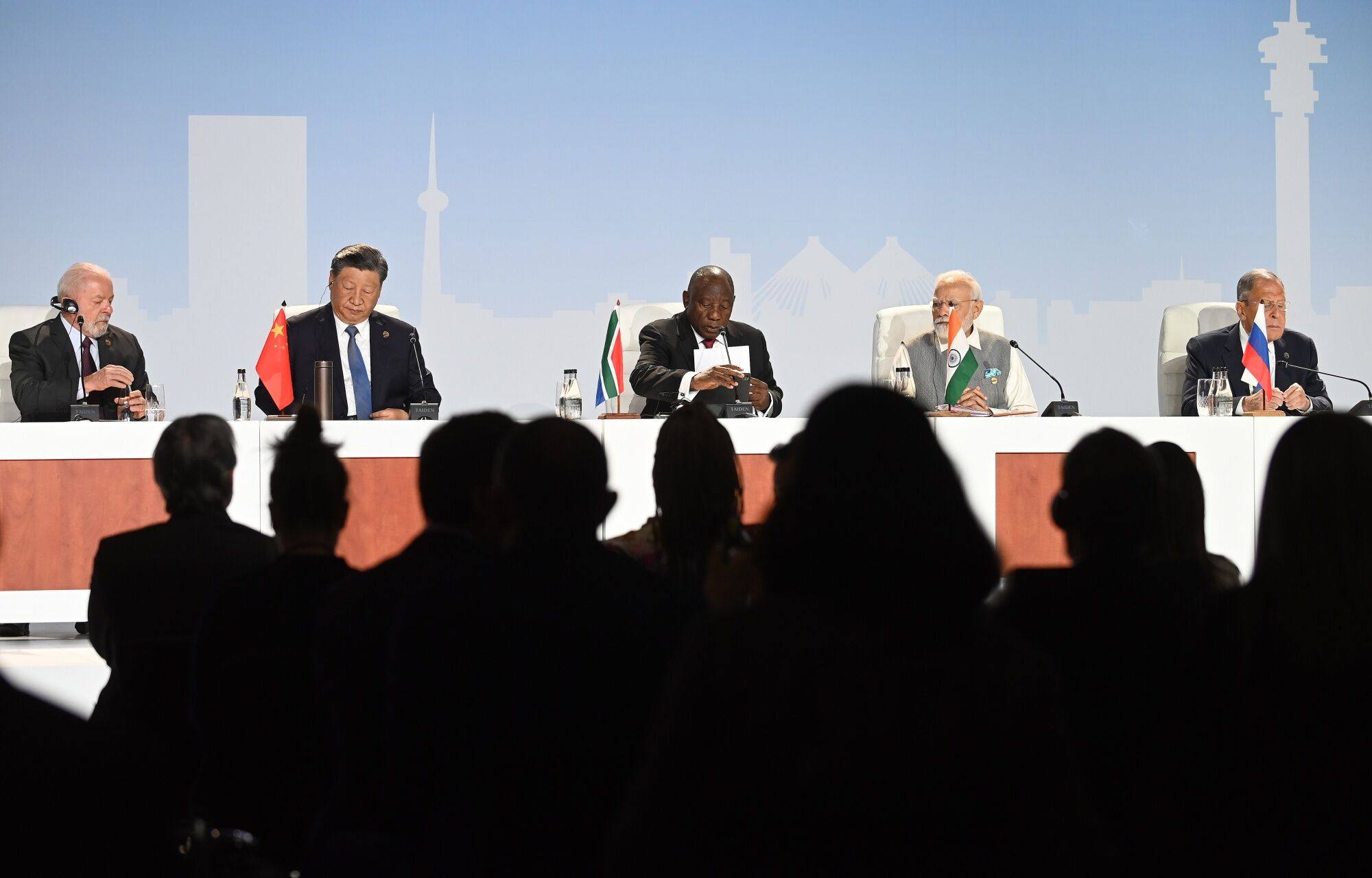

Bringing three major oil producers into the fold might appear to be mainly a move by the grouping to ensure future energy security, but it is also about an evolving Brics financial and economic strategy.

None of this is going to produce an overnight funding miracle for Brics governments, or any others for that matter. But as more nations realise that two can play the game of securing seemingly endless budget and current account deficit financing, the game will change.

Expanded Brics will continue to chip away at US dollar’s dominance

Expanded Brics will continue to chip away at US dollar’s dominance

China is a prime mover behind what might be termed this long game of reducing US dominance of the international financial system while the US focuses on blunter instruments such as tariffs and other trade restraints such as bans on exports of technology to China.

Anthony Rowley is a veteran journalist specialising in Asian economic and financial affairs

[ad_2]

Read More: Opinion | True lesson of US dollar privilege won’t be lost on expanded Brics

2023-09-02 22:15:13